Over the past 2 decades, India’s consumer goods market has registered phenomenal growth and the credit goes to the country’s gradual but consistent income growth with the young generation at the core.

Here, it should be underlined that the majority of India’s population is young.

Now, as India’s growth has outpaced other major economies, our consumer economy, which is just behind China, the US, Germany, and Japan, is likely to jump to third place in a few months.

This is as being observed by USB Securities. Business News India.

Industry pandits place India at a crucial junction, where our flow will be set for the coming decade, and we are likely to surpass Germany and Japan.

Edelweiss Mutual Fund has released a report which declares the consumption expenditure in India to become second in the world by the time we breathe in 2030. Tech news updates in India.

Rise of Upper-Middle Income Group: Tech News Updates in India

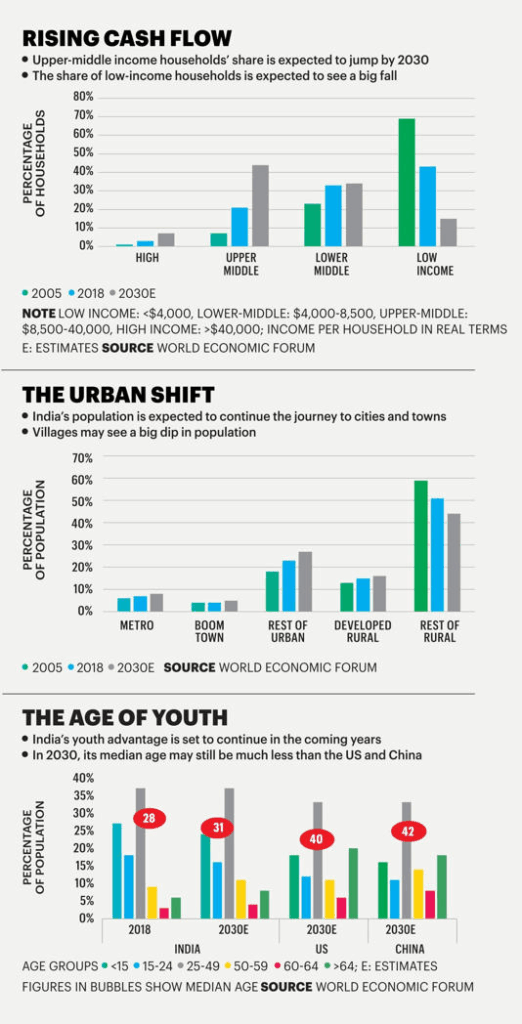

Besides, it lays down that within the same time window, the middle and upper-middle income groups (which expand at a considerable rate) will contribute to a 46% growth in consumption expenditure.

Such a prediction of a swelled upper-middle class appeared true.

Nevertheless, we ought to be mindful of the fact that in the recent Union Budget of 2025-26, the income tax slab has been lowered, giving maximum room for consumers to turn on their spending faucets.

World Economic Forum Comes With Its Own Data:

In data compiled by the World Economic Forum (WEF), such predictions might fail to amaze (as being unrealistic) initially. Business News In India.

When we compare the 2005 data, the high-to-upper-middle class families in India constitute 17 million. But by 2018, that number quadrupled to 69 million.

The figure is likely to augment by another 185% which translates to 197 million in the coming 3 years reflecting that 7% more Indians will make it the high-income club.

Now, we have Rohit Jawa, CEO and Managing Director of Hindustan Lever Limited, which is India’s largest FMCG who opines, “These projections have got the consumer goods industry dreaming, despite the temporary blip in recent years.

“India’s consumer market is poised for a significant transformation.”

Opening up before the media, Mr Jawa stresses an inflection point in the long run by saying,

“We can easily point out a long-term inflection point which is for the long-run as Mr Jawa says, “driven by growing affluence, improved access to digital and physical infrastructure, and median age of less than 30 years”.

“India’s consumer market will likely be identified by democratisation of aspirations for a better life and shift towards sophisticated consumption patterns,” he reveals before media.

According to Saugata Gupta, MD & CEO of Marico, with a mega population which is most young, India is potential enough to emerge one of the biggest consumer markets in the world. “We envision the Indian consumer market undergoing a profound transformation. It is on the cusp of significant growth in the coming years,” he adds.

The country, not only has the largest population in the world at 1.4 billion, but the consumer strength is also big in it.

WEF’s projections show that while in 2018, about 82% of the population comprised those less than 50 years old, by 2030, the share will dip only marginally to 77%, with the 15-49 age group comprising 53% of the population. In comparison, 45% of the US population will be in the 15-49 age group; for China, it will be 44%.

Looking at the data, rapid urbanization will strengthen this pattern.

By 2030, we can easily speculate that urban centres will house 40% of Indians which would be an increase from 34% as was in 2018 while in 2005, the figure was 28%.

India has the world’s largest population in the world and then, as the icing on the cake, the majority of the population is young.

World Economic Forum maintains that while 82% of the population was under 50 in 2018, that percentage will only dip minutely to 77% by 2030, with 53% of the population plunging to the range of 15-49 years of age.

On the other side, in the case of China, 44% of its people will be in the age group of 15 to 49 years, while in the case of America, the percentage rests at 45%.

Another key trend is increased access to information through smartphones and better internet access. This has sparked a shift in preference for better quality products from established brands.

“Growth will come from premiumisation and new category adoption. This will be more pronounced in the top 100 cities,” says a Nestlé India spokesperson.

Challenges are intact, no doubt. Inflation has been fierce in the present time and growth has slowed down while youth are unemployed in a large number and such factors have combined to weaken consumption in rural and urban centres.

As consumers cut down on spending, sales of all consumer goods categories have faced speed bumps in recent quarters. From 7.5% year-on-year (YoY) growth in urban FMCG offtake in the December 2023 quarter, sales growth plummeted to 1.9% in the June 2024 quarter, only to recover to 5% in the December quarter, data from market research firm NielsenIQ shows.

FMCG draws 36% of the demand from the rural market and this gave space to hope but development has been sluggish in recent years yet demand has strengthened despite the low base.

It registered 9.90% YoY growth in the last quarter of 2024. Actually, beginning in March 2024, the rural market has shown tremendous growth leaving its urban cohort behind which is attributed to less action in the urban centres.

Now, by looking at the smartphone market, which had a vast momentum globally, has slowed down in recent years and the sales have been mediocre in recent times.

On looking at the data shared by market intelligence company IDC, smartphone shipments have risen in India by 4.1% in 2024.

But ironically, during the holiday months beginning from October till December which is the best time for sales, the market slowed down by 3%.

Here, the IDC researchers opine that to tackle the slip, the vendors and the channel partners continued with a cost crunch by enabling discounts and unleashing device warranties in the wake of the holiday season.

No doubt, the consumption worries will precipitate if the needed boost is achieved by the cut in income tax to benefit those making Rs 12 lakh. This is mainly because of the Trickle Down Eonomic Theory which comes into play here.

“With policies in the Union Budget FY26, we anticipate middle-class consumption to surge, driven by increasing disposable incomes, job creation, urbanisation, and digital adoption,” says Gupta.

In the years to come, this is expected to boost consumer spending with a sizeable portion going towards essential categories like food, beverages, apparel, and personal care, he says.

Discount the tax boost, but India needs to work on job creation and resolve the issue of skilled workers’ shortage.

Here we have Madhavi Arora, who is Chief Economist at Emkay Global Financial Services, admits, “while youth unemployment is hitting the household income growth hard but then the bigger issue is the dearth of skilled workers.“

“Employers are unable to find suitable candidates for the job profile on offer. There is a clear mismatch between skill sets required and available human capital,” she asserts.

Such are the blips which are short-lived in the country’s long-term growth story and should not be given attention, say industry stalwarts.

Jawa is full of expectations from the country’s young population and believes in their potential fully.

“Job creation and income growth are critical, and strategic investments in education, skill development, and infrastructure will unlock the demographic dividend,” he says.

Verily, India is the most populous country in the world and tremendous opportunities can be unlocked for occupations that serve rural and urban consumers.

Well dear reader, please keep visiting our website as we strive hard to bring you the latest happenings in the world of tech, science and environment.

Can India address the jobs and skills crisis to make it the world’s biggest consumer market?