New Boeing and Airbus, gigantic aircraft are exclusively made-to-order while some are still due to cater to freight needs.

Iconic players of the sea freight A.P. Moller-Maersk and CMA-CCM take a giant leap in such aerial direction rather than considering distances in nautical miles.

Dear reader, this should be kept in mind here that shipping prices (and so were the profits) Skyrocketed during the horrific pandemic.

Truly, to be a successful oceanic freight carrier, it calls for extremely high-end skills glued to long-term planning.

This is also because huge costs are involved in the design of new ships which is a time-consuming task too (in fact, several years).

Massive Boost In Sight: Tech News Updates in India.

Undoubtedly, for these two shipping giants A.P. Moller-Maersk and CMA CGM, such a flight is highly likely to grease the wheels of their service cart(s) (jet engines in the case of Boeing).

Sans doubts that long-term planning is worth it.

The companies are out to build such a capacity and received the Boeing 777 freighters a few months ago while some more aircraft are likely to be dropped by soon, as per their business contract.

The commitments to diversify their operations during the pandemic’s peak, when consumers were in dire need of air and sea transportation, are embodied in these new aircraft.

After making investments in the trucking portion of the logistics industry, Maersk and CMA CGM are now building their first new aircraft to compete in the air-freight market.

During the COVID-19 lockdown worldwide, shipping prices skyrocketed, and the infusion of capital from this once-in-a-generation cycle allowed marine operators to diversify.

Maersk’s operating profit in 2022 was $31 billion. Now, industry stalwarts say that the difficult phase is yet to be afloat.

Maersk and CMA CGM must wrest ground in a market that will be fiercely guarded.

Truck Transportation Still Sails Through Recession:

The much-discussed recovery is still a far-off mirage as the truck transportation industry enters its second year of recession.

July saw the seventh consecutive month of double-digit volume growth, up 14% from last year.

There’s a strong likelihood of a pleasant increase throughout the year-end peak season.

According to a series of charts from Susquehanna Financial Group analyst Bascome Majors, which are typical to his style, so densely packed with data points that the colourful, squiggly lines resemble a Jack on Pollock artwork, air cargo rates rose 5% to 20% during the four weeks at the end of the third quarter from 2015 to 2019.

Majors highlighted in a September report, “We expect a moderate increase in air cargo rates within the stated range as we approach peak season,”

Right Occasion Argued:

The timing is right for both shipping companies to enter the air freight market, but it’s a risky one.

Cargo is also carried in the lower holds of passenger aircraft; this so-called belly capacity has been growing as airlines return to regular service, especially on routes to and from Asia.

The Beginning Of This Venture:

Maersk and CMA CGM are taking different approaches to carve out that position; Maersk will handle its operations in-house and has flying experience.

In 1669, the company established a passenger airline, which it sold off in 2005.

Since then, it has flown cargo for UPS under Star Air, a unit that operated 15 aircraft in 2021.

The Danish company increased its interest in air cargo by acquiring Senator International in 2022, which it combined with Star Air to form by acquiring Senator International in 2022, which it combined with Star Air to form Maersk Air Cargo.

CMA CGM is collaborating with Atlas Air Worldwide Holdings, which was acquired by a group of private investors led by Apollo Global Management last year, to operate its aircraft.

The French shipping company anticipates having 13 new Boeing 777 andAirbus and A350 freighters by the end of 2027, according to Damien Mzaudier, chief of the air-cargo business.

What number of aircraft would be required over a specific period?

Mazaudier was queried where he replied, “the sky is the limit, “It’ll take time to develop this. So, we will go progressively.”

The pandemic’s unexpected cash inflow provided the ocean carriers with the impetus to start developing an asset-based logistics service from tip to tail (or bow to stern).

Although Maersk and CMA CGM will face competition and experience volatile market conditions, they must adhere to this diversification strategy even as the pandemic’s effects become less apparent.

This is because, in the medium term, ocean carriers may face significant pressure as global trade slows down from the boom years of the 1990s.

The current trend of placing factories closer to the countries where the product will be used (or at least on the same continent) has the potential to last a long time.

The impetus for this trend stems from the deteriorating relations between China, which has supported Russia following its invasion of Ukraine, and the US, Europe, and its allies.

The pandemic served as a wake-up call regarding how heavily the US economy depends on Chinese goods.

Additionally, there is an environmental argument in favour of placing production closer to the point of consumption rather than transporting various components of production from around the globe.

Automation is lowering the labour cost of operating factories, allowing for more manufacturing in high-wage markets.

Businesses place orders for ships during boom times, but these usually come after the boom has subsided.

And then there’s China, with its goal of becoming the world’s most powerful nation in the maritime industry, both militarily and commercially.

The plan began with steel, and as it grew, it expanded to include shipyards and the construction of cranes to unload ships at ports.

China’s astonishing success was fueled by the central government’s budget and strategic planning that tied Adam Smith’s invisible hand, which in a normal market would have encouraged players in the industry to make cautious investments and avoid severing ties.

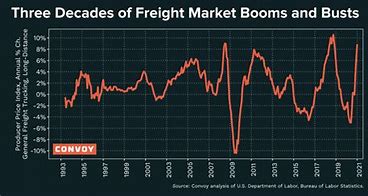

“It’s a boom-bust business, and the cycles never last that long,” said Lee Klaskow, who works as a senior analyst for logistics at Bloomberg Intelligence.

“When things are good, people order ships. And then demand goes away and all the ships come on the water. When you buy an asset for $70 million to $100 million, you’ve got to use it.”

To get a clear picture of the boom versus the bust, Maersk had clubbed operating earnings of $51 billion in 2021 and 2022 which were just $2.5 billion in 2018 and 2019.

Clearly, the sea turns harsh for such companies operating in maritime shipping as they set to branch out into new markets.

But then, on the brighter note, financial gains are expected to be thicker with minimal bust.

Here, we shall keep you posted.

4 Comments

üsküdar elektrikçi SEO çalışmaları sayesinde Google sıralamalarında hızla yükseldik. https://royalelektrik.com/

I do trust all the ideas youve presented in your post They are really convincing and will definitely work Nonetheless the posts are too short for newbies May just you please lengthen them a bit from next time Thank you for the post

Blue Techker I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

Good day very cool blog!! Man .. Excellent .. Amazing .. I will bookmark your site and take the feeds additionally…I am glad to find so many helpful information right here within the publish, we want work out extra techniques in this regard, thanks for sharing. . . . . .